2026 Medicare Part B & D IRMAA and Part A Deductible and Coinsurance amounts

On November 14th, 2025, The Centers for Medicare & Medicaid Services (CMS) has announced the 2026 premiums, deductibles, and coinsurance amounts for Medicare Parts A and B, along with the 2026 income-related monthly adjustment amounts for Medicare Part D.

At Morrissey Wealth Management, we annually project and review our client’s modified adjusted gross income (MAGI) to avoid triggering unwanted Medicare premium increases when possible. In 2026, the standard Medicare part B premium has been increased, in addition to the income-related monthly adjustment amounts. The increase to the standard premium, as reported by the Centers for Medicare & Medicaid Services, is mostly a result of projected price changes and assumed utilization increases that are consistent when cross referenced with historical data.

The Importance of Planning Ahead

Your current year Part B & D income-related monthly adjustments(IRMAA) to Medicare premiums are calculated by using your modified adjusted gross income (MAGI) reported on your tax return from two years prior, and cross referencing this figure with the current year premium adjustments (2026 IRMMA tables included below). For further clarification, this means that your 2026 Medicare premiums are based on the reported MAGI on your tax returns from the tax year 2024.

This can be a shocking added expense for any retirees, including those who worked up to the age of 65, when they first become eligible for Medicare and now have a much lower income in retirement, but must budget accordingly for the added health care expense that is calculated based on their income levels from years they were previously employed.

For reference: In 2026, by triggering the first income-related adjustment threshold, a married couple who are both enrolled in Medicare are required to pay an additional $2,296.80 collectively for the same part B & D coverage.

Medicare Part A Premium and Deductible

Medicare Part A helps cover inpatient hospital stays, skilled nursing facility care, hospice services, inpatient rehabilitation, and certain home health care services. The good news is that about 99% of Medicare beneficiaries pay no monthly Part A premium because they have accumulated at least 40 quarters of Medicare-covered employment, as determined by the Social Security Administration.

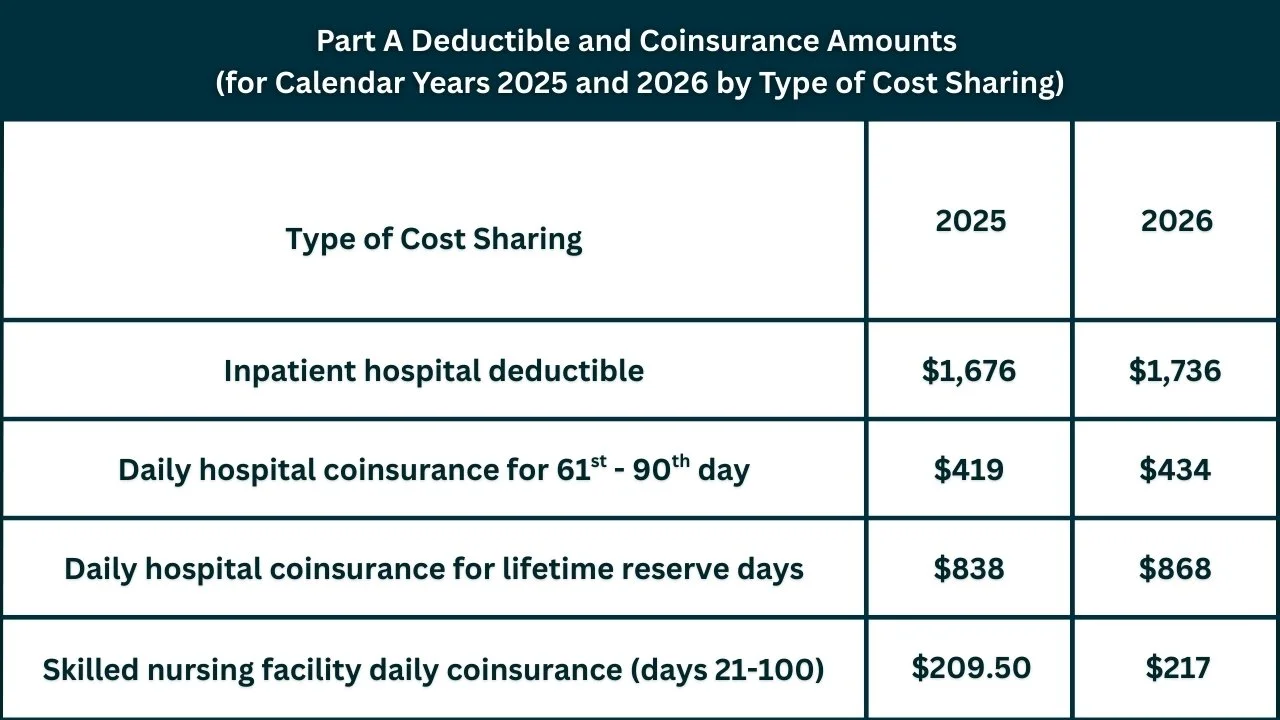

For 2026, the Medicare Part A inpatient hospital deductible will increase to $1,736, up $60 from $1,676 in 2025. This deductible represents the beneficiary’s share of costs for the first 60 days of Medicare-covered inpatient hospital care during a benefit period.

If a hospital stay extends beyond 60 days, additional coinsurance applies. In 2026:

Beneficiaries will pay $434 per day for days 61 through 90 of a hospitalization (up from $419 in 2025).

For lifetime reserve days, the coinsurance amount will be $868 per day, compared to $838 in 2025.

For care received in a skilled nursing facility, beneficiaries will pay a daily coinsurance of $217.00 for days 21 through 100 of extended care services during a benefit period, an increase from $209.50 in 2025.

Figures sourced directly from The Centers for Medicare & Medicaid Services (CMS)

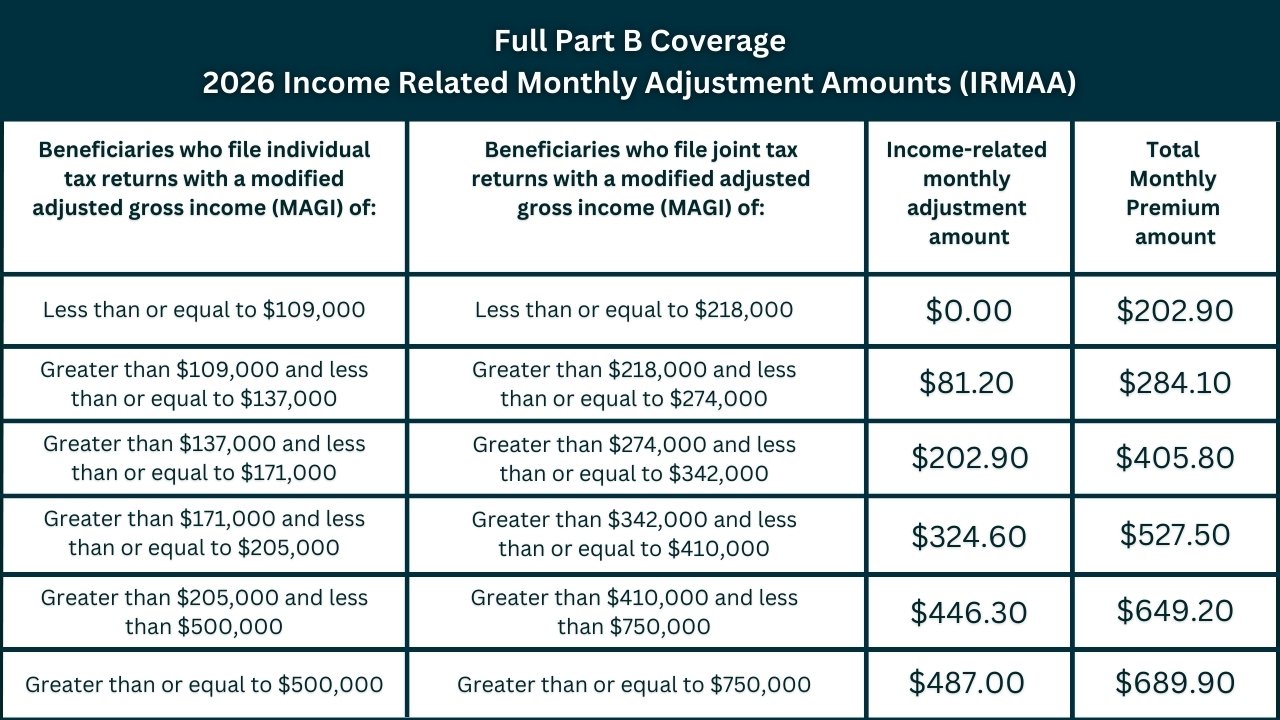

Medicare Part B Income-Related Monthly Adjustment Amounts (IRMAA)

Since 2007, Medicare Part B premiums have been income-based, meaning higher-income beneficiaries may pay more than the standard monthly premium. These income-related monthly adjustment amounts (IRMAA) currently affect approximately 8% of Medicare Part B enrollees.

For 2026, beneficiaries with higher incomes and full Part B coverage will pay increased total monthly premiums based on their income level. The applicable 2026 Part B premiums for high-income beneficiaries are outlined in the table below.

Figures sourced directly from The Centers for Medicare & Medicaid Services (CMS)

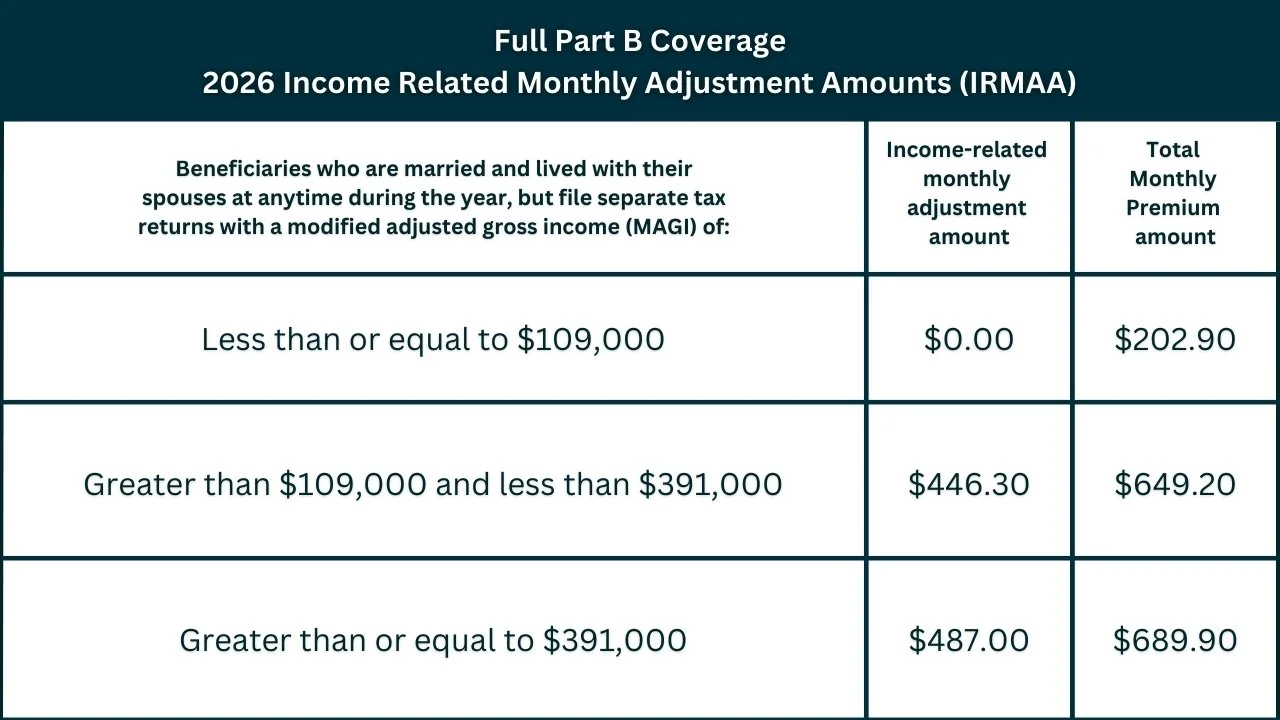

Premiums for high-income beneficiaries who have full Medicare Part B coverage, are married, lived with their spouse at any point during the taxable year, and file a separate tax return are outlined below:

Figures sourced directly from The Centers for Medicare & Medicaid Services (CMS)

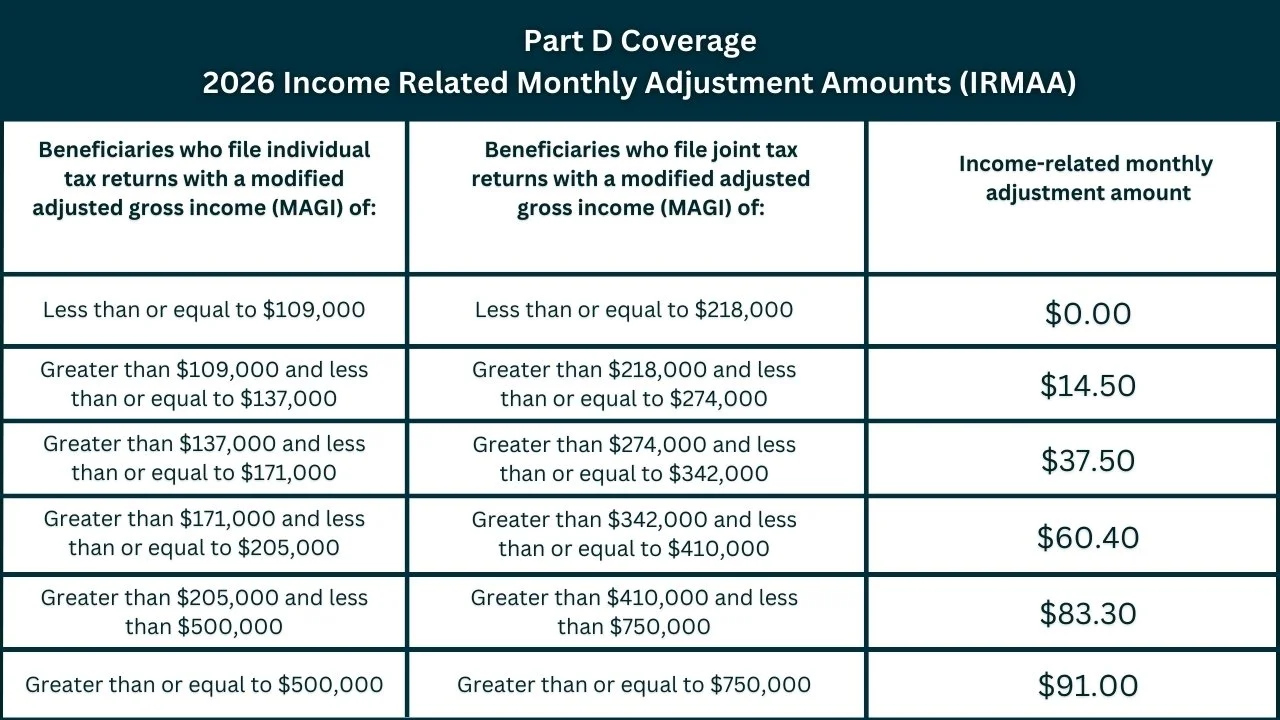

Medicare Part D Income-Related Monthly Adjustment Amounts (IRMAA)

Medicare Part D uses an income-based pricing structure for beneficiaries with higher earnings. Under this system, certain individuals are required to pay an income-related monthly adjustment amount (IRMAA) in addition to the standard premium for their selected Part D prescription drug plan. Roughly 8% of Part D enrollees fall into this higher-income category.

The IRMAA charge is separate from the plan’s base premium, which varies depending on the prescription drug plan chosen. While beneficiaries may pay their regular Part D premium either directly to the plan or through a deduction from their Social Security benefits, the income-related adjustment is always collected by Medicare—either as a deduction from Social Security payments or through direct billing.

Most beneficiaries—approximately two-thirds—pay their Part D premiums directly to their prescription drug plan, with the remainder having premiums withheld from Social Security benefits. The applicable 2026 Part D income-related monthly adjustment amounts for higher-income beneficiaries are summarized in the table below.

Figures sourced directly from The Centers for Medicare & Medicaid Services (CMS)

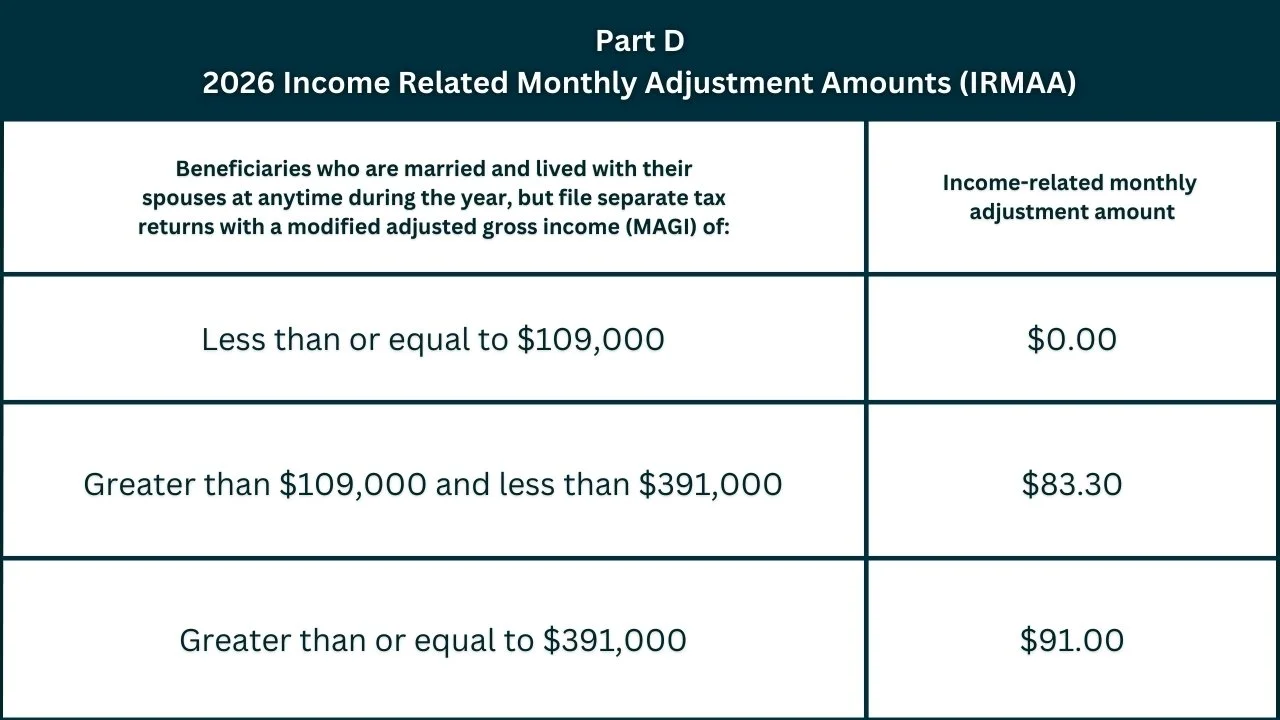

Premiums for high-income beneficiaries who have full Medicare Part B coverage, are married, lived with their spouse at any point during the taxable year, and file a separate tax return are outlined below:

Final Thoughts

Understanding the changes to Medicare costs for 2026 can help you plan more confidently for the year ahead. Premiums, deductibles, coinsurance, and income-related adjustment amounts (IRMAA) have all shifted, and those with higher incomes may see notable increases under the Part B and Part D IRMAA tiers. Taking time now to review your projected income, consider strategies to manage your Modified Adjusted Gross Income (MAGI), and evaluate supplemental coverage options can make a meaningful difference in your overall health care expenses. Medicare remains a critical foundation of health security in retirement, but informed planning is key to minimizing surprises and maximizing financial comfort as you navigate these cost changes.

If you’d like my help in developing a comprehensive plan for your retirement; one that covers your personalized retirement risk management, tax planning, estate planning, investment portfolio and retirement cash flow optimization, then click below to book an introductory call with me to learn more!

If you have a question or topic that you’d like to have considered for a future episode/blog post, you can request it by going to www.retirewithryan.com and clicking on ask a question.

As always, have a great day, a better week, and I look forward to talking with you on the next blog post, podcast, YouTube video, or wherever we have the pleasure of connecting!

Written by Ryan Morrissey

Founder & Principal Wealth Advisor of Morrissey Wealth Management

Host of the Retire with Ryan Podcast